This is the Biggest Speculative Bubble Since 1929… It Will End in Similar Fashion

We’re on the Brink of Another Global Depression.

An epic collapse is coming, and it's going to be big.

Exactly when it happens – next week, next month, or next year – I can’t know. But I do know this – all the other times we’ve seen what we see now, it turned out badly.

While the upcoming crisis is global in nature, for this article, I’m just going to focus on the U.S. investment markets.

Back on December 7th, I posted a video titled, “This is Scary... The Last Time It Happened Was 1929!” In it, we went over all the parallels between the lead up to the epic collapse we saw at the beginning of the Great Depression and what we see right now. Since then, it’s only gotten worse. Again, the extremes are unprecedented, even when compared to 1929.

So what are some of the extremes? Let’s start with this…

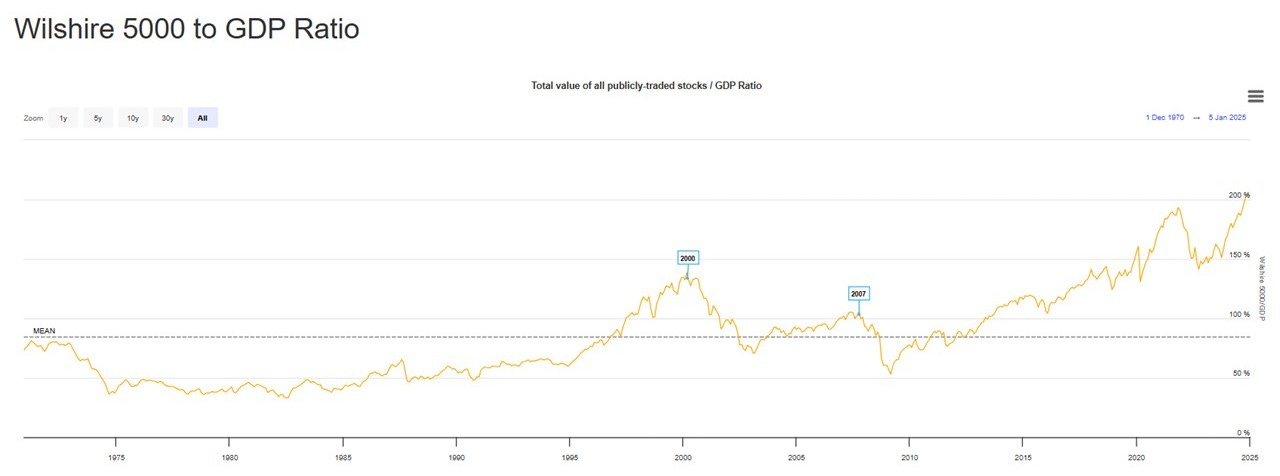

The Buffett Indicator

The Buffett Indicator gets its name from famed investor Warren Buffett. Reportedly, this is Buffett’s favorite metric for judging whether or not the stock market as a whole is fairly valued. It takes the market capitalization (or total value of the U.S. stock market) and divides it by the gross domestic product (GDP). This compares the value of the stock market to the total value of the U.S. economy. At fair value, the ratio should be about 60%. Here’s where it currently stands:

As you can see right now, it's well over 200%. This is unprecedented. This chart only goes back to 1970. But you can see the peak of the Dot-Com Bubble was around 138%. Right before the great financial crisis, it was 105%. Prior to the last correction, it hit a peak in 2021. Now, it’s even higher. We're at entirely new levels of extreme.

I don't know when this bubble will burst, but it will. Could it be this year? It could be. There’s no way to know for sure, but I can tell you this – whenever we’ve seen these conditions in the past, it’s always ended in tears. Every time, it’s ended with at least a correction, and in most cases, a crash. Maybe this time is different. But history tells us that’s unlikely.

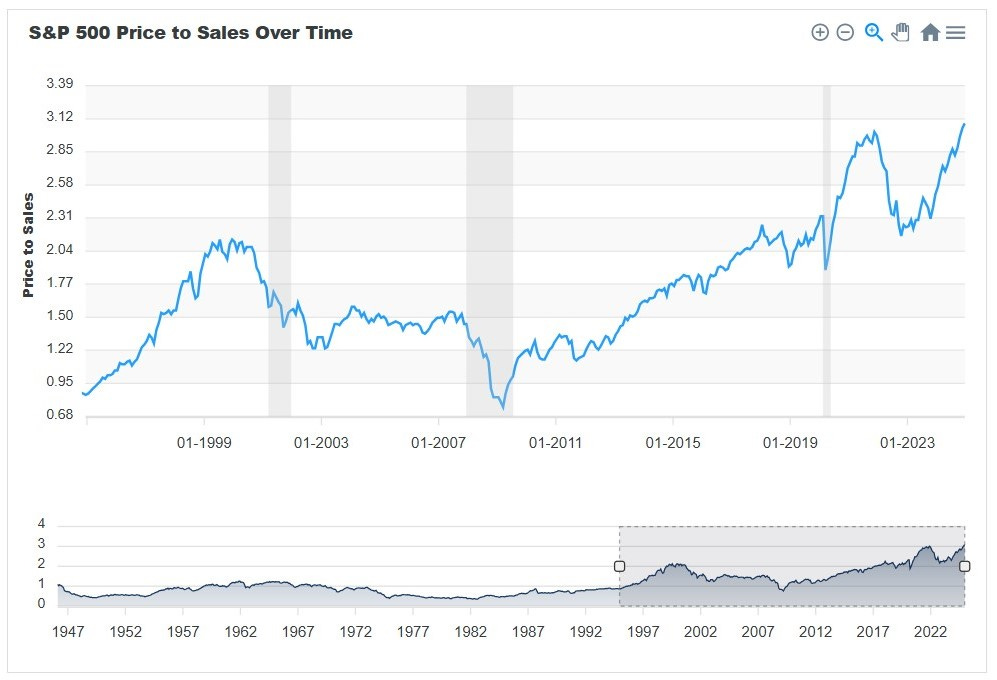

S&P 500 Price-to-Sales Ratio

Another extreme we see is the S&P 500 price-to-sales ratio. Here’s a chart:

As you can see, they only have data on this chart going back about 30 years. But you can see in the lead up to the Dot-Com Bubble, it was 2.11. Right now, it's 3.07 – the highest on record.

We’re now at a peak that has never been reached before. But it’s not just the entire market that’s overvalued.

Here’s a list of the top 7 stocks in the S&P 500 and what percentage of the index they constitute:

These seven stocks make up more than 30% of the total value of the S&P 500.

Does that surprise you? It should.

When most people buy an S&P 500 index fund, they think it means they’re buying an equal share in all 500 companies in the index, but they aren't equally weighted. For example, Apple is only 1/500th of the S&P 500, but it constitutes 7.41% of the S&P 500’s value.

The top seven stocks equal almost a third of the entire value of the index, even though those seven stocks are just a little bit more than 1% of the companies in the index. This means we’ve lost sight of the biblical principle of diversification:

"Send your grain across the seas, and in time, profits will flow back to you. But divide your investments among many places, for you do not know what risks might lie ahead." Ecclesiastes 11:1-2 (NLT)

When you deviate from biblical principles, bad things happen.

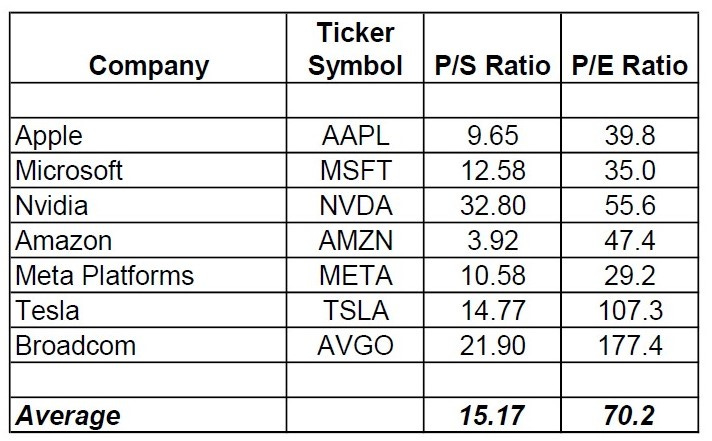

So what’s the price-to-sales ratio for each of these companies? Here’s a list:

Out of the top seven stocks, six have a price-to-sales ratio that rounds up to 10 or higher. Why does that matter? In the aftermath of the Dot-Com Bubble, the CEO of Sun Microsystems, Scott McNealy, explained why in a very famous interview:

"At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?"

In light of what you just read, think about where we stand. Six of the top seven stocks, comprising over a third of the S&P 500 right now, sport a price-to-sales ratio exceeding 10. Some of them are even higher than 10. NVIDIA is at 30.

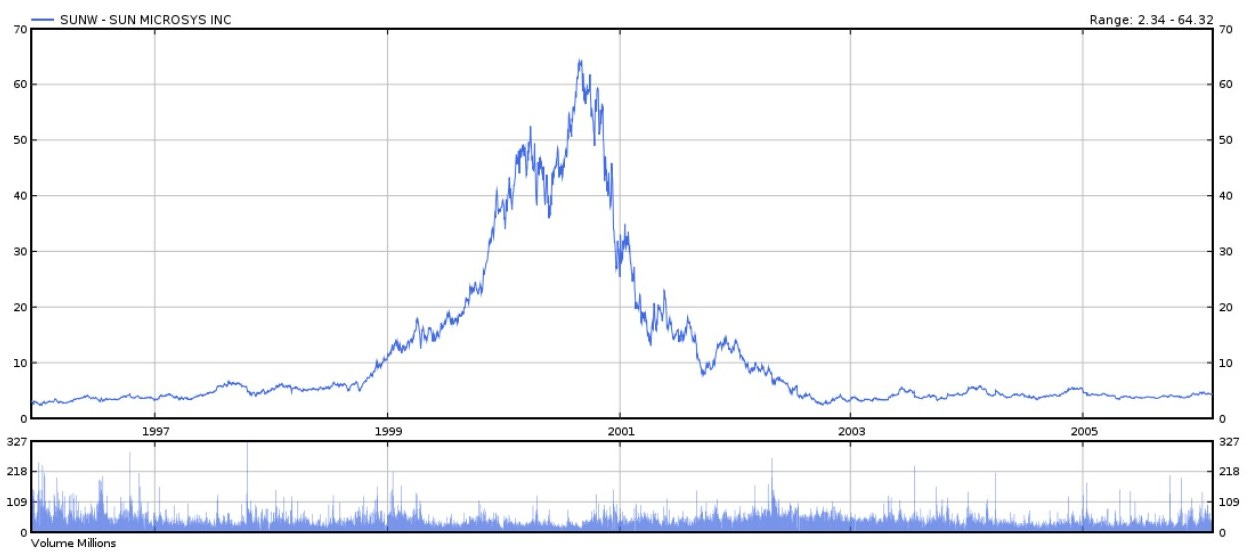

All of the fundamentals that applied to the overvalued stock of Sun Microsystems during the Dot-Com Bubble now apply to six of the biggest companies in the world. To understand what that means, take a look at this chart of Sun Microsystems from 1996 to 2006:

Sun Microsystems stock started at around $5 per share, ran up to $64 per share, and then fell right back down to $5 per share. You would think this might serve as a cautionary tale for investors today, but obviously, the lesson wasn’t learned.

Unprecedented Market Concentration

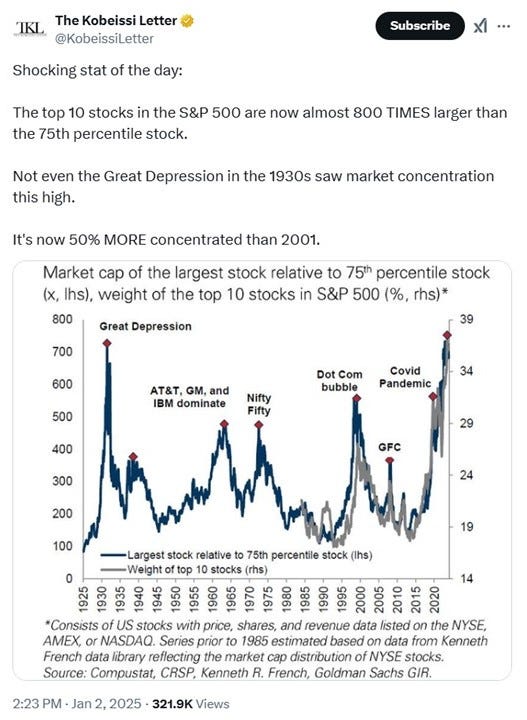

Here’s an X post from The Kobeissi Letter:

It shows the top 10 stocks in the S&P 500 are now almost 800 times larger than the 75th percentile stock. Not even the Great Depression in the 1930s saw market concentration this high. It's now 50% more concentrated than 2001 – in the midst of the Dot-Com Bubble collapse.

Right now, we’re at unprecedented levels of concentration.

This will not end well. Again, the markets have strayed from the biblical principle of diversification as recorded in Ecclesiastes 11. Investors are not buying 500 individual stocks equally weighted when they buy S&P 500 index funds. They're really buying just a handful of companies that are extremely overvalued at the moment.

But bubble conditions aren’t limited to the S&P 500 alone. We see rampant speculation in cryptocurrencies, especially when it comes to meme coins.

This work is a full-time endeavor for our family. Without the support of readers, viewers, and listeners like you, the work we do here would not be possible. If you like what you see, please consider becoming a paid subscriber.

As a paid subscriber, you’ll get weekly paid-subscriber videos and/or articles, a monthly live Q&A via Zoom, commenting privileges on every post, access to the complete archives, and more. Most of all, you get to support this work which spreads the Good News of Jesus Christ to tens of thousands of people in over 100 countries.

Dogecoin

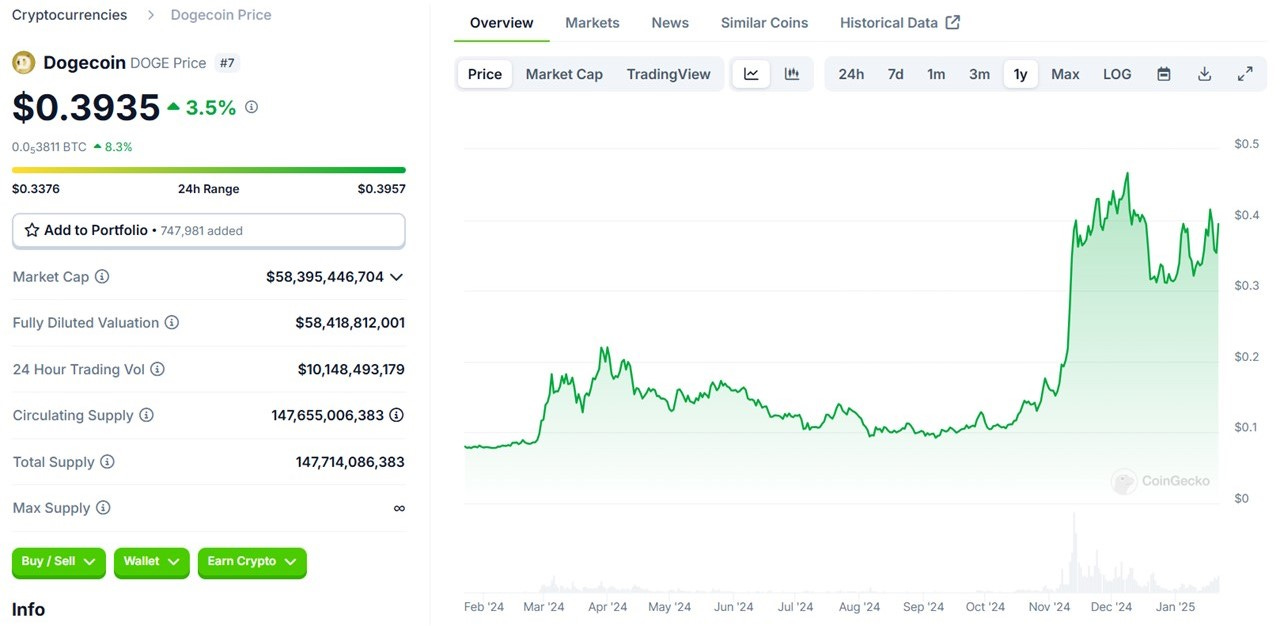

A prime example is Dogecoin. Here’s a chart of Dogecoin:

Dogecoin is currently worth $58 billion. $58 billion!

What is Dogecoin? It's more than a cryptocurrency. According to Wikipedia:

“Dogecoin is a cryptocurrency created by software engineers Billy Marcus and Jackson Palmer, who decided to create a payment system as a joke. making fun of the wild speculation and cryptocurrencies at the time. It's considered both the first meme coin and more specifically the first dog coin. Despite its satirical nature, some think it's a legitimate investment prospect.”

Dogecoin is a joke – literally. Its founders created Dogecoin 11 years ago as a meme coin parody. Today, it's worth $58 billion. This will not end well.

The people who think they're “investing” in Dogecoin are really speculating and gambling on Dogecoin. They expect it to go higher and higher so they can eventually cash out and become rich. But history tells us only a few people will cash out at the top. The overwhelming majority will lose a lot of their life savings, pouring their hard earned savings into joke meme coins.

Think this is an extreme example? Well, it’s not the only joke meme coin. Here’s one I never thought I'd be talking about. It’s called “Fartcoin.”

Fartcoin

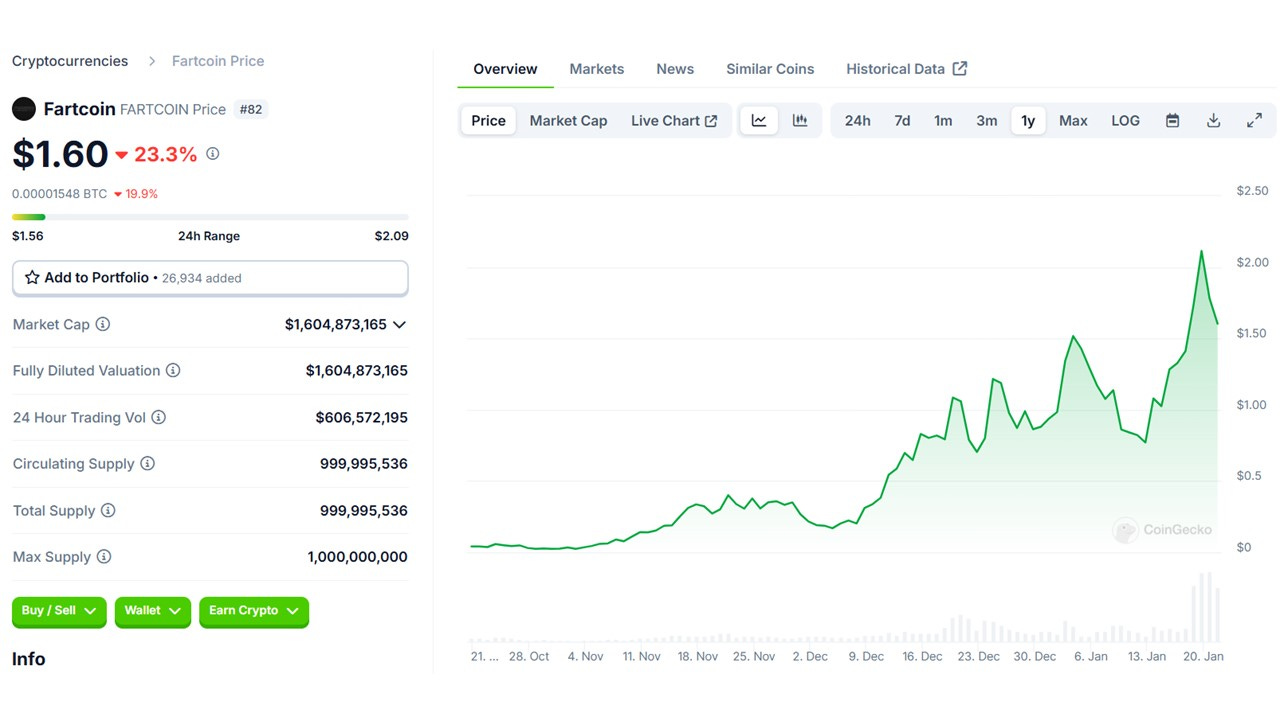

Here’s a chart of Fartcoin:

It’s worth $1.6 billion. Why? Is it because Fartcoin has great value to the world? Is it because Fartcoin will spark a revolution in how the world operates? No. It's nothing but pure speculation. It's gambling.

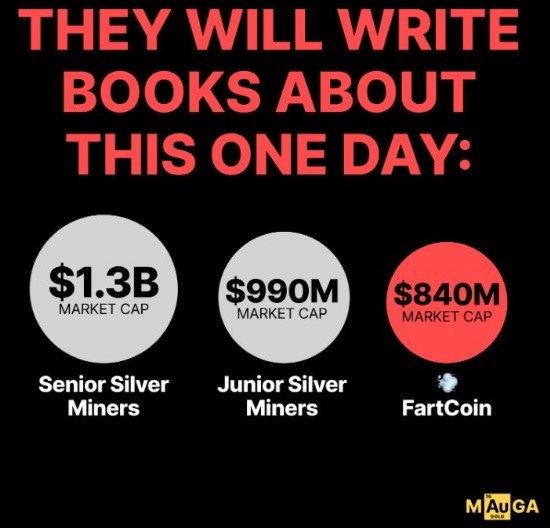

Much like we saw in the lead up to the 1929 crash and the lead up to the Dot-Com Bubble where people would buy anything with dot-com in it, people are buying up meme coins - any meme coin they can find. The valuations are absurd. For instance, look at this X post:

This post was from December 16, 2024. Fartcoin is higher now. As I write this article, it’s worth $1.6 billion.

In contrast, all the junior silver miners are valued at $990 million, and all the senior silver miners (meaning all the publicly traded senior silver mining companies) are worth $1.3 billion. Right now, “investors” have valued Fartcoin more than the leading silver mining companies.

So let's put this in perspective. If Fartcoin disappeared tomorrow, would anybody (other than the people who are speculating in it) notice? The answer is no.

But what if the silver miners disappeared tomorrow? If that happened, the world as we know it would come to a screeching halt. Silver is essential to modern life. We can't make cell phones or computers or almost anything electronic without silver. To say Fartcoin is more valuable is grossly absurd. As the X post puts it, “They will write books about this one day.”

Unfortunately, that’s true.

They will write books like this one right here:

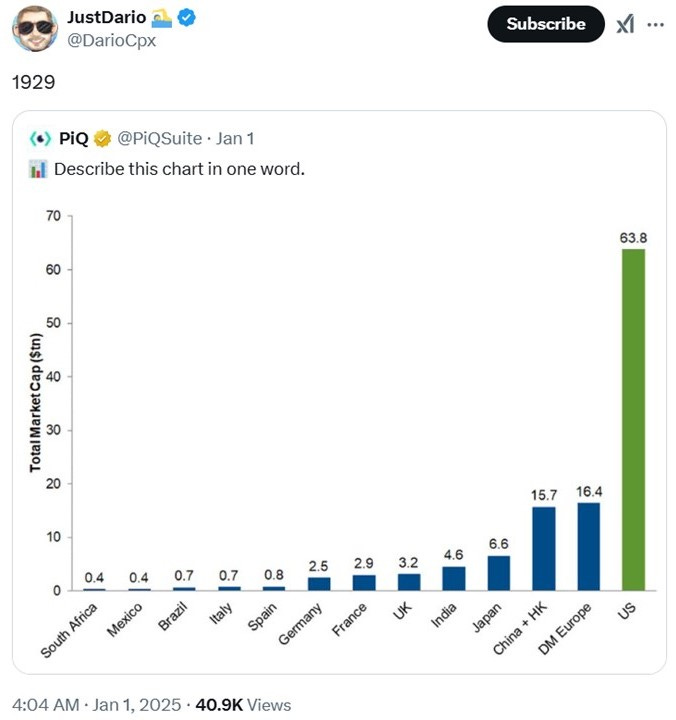

For those with eyes to see, the parallels between today and 1929 are clear. We have joke meme coins created out of thin air selling for billions of dollars. People are wildly speculating in the markets, hoping to strike it rich. And we see massive overvaluations such as this:

Valuations are now at extremes we have not seen since 1929.

So how will all this end?

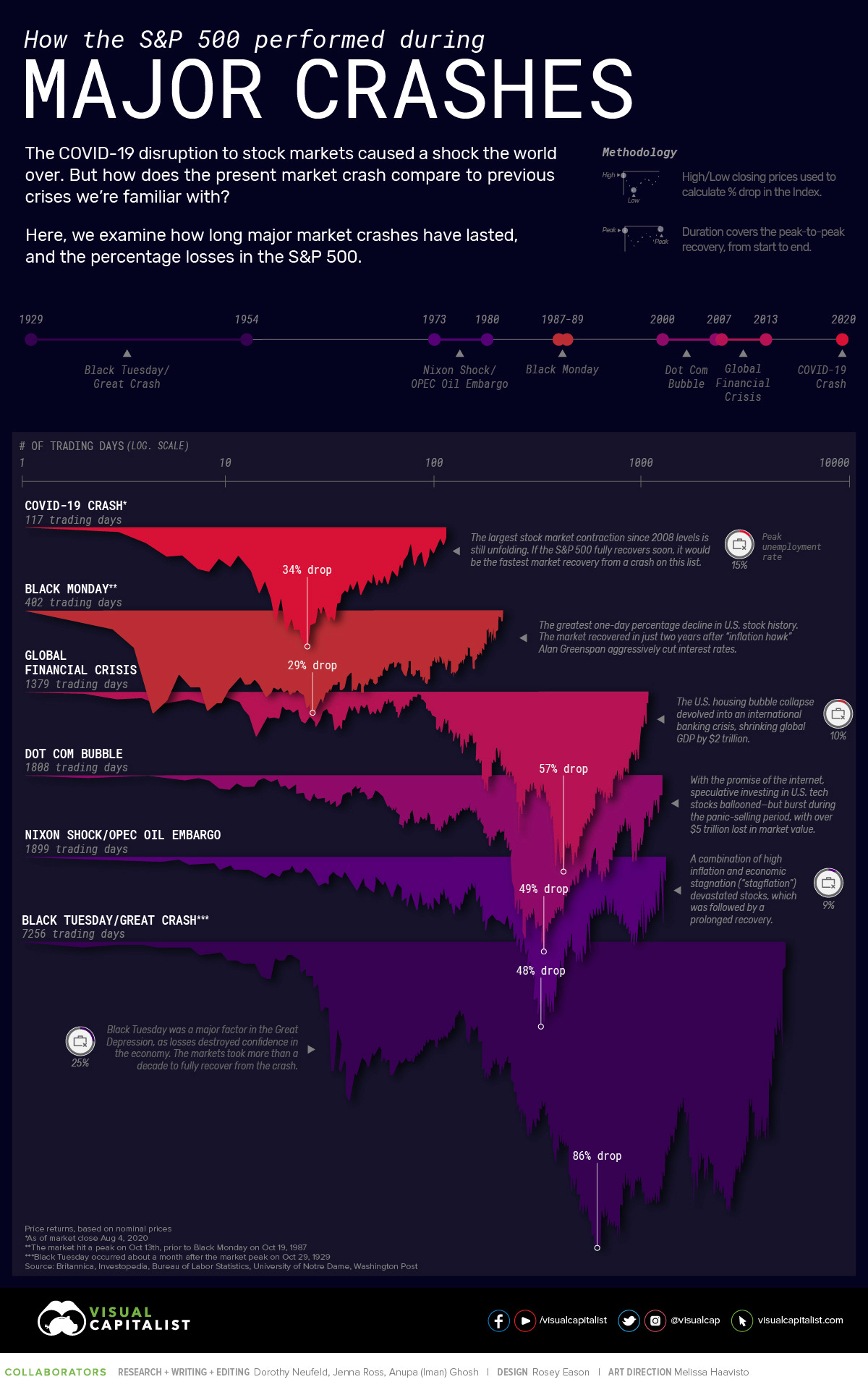

Here are some possibilities based on what’s happened in the past:

Again, I don't know when it will all come crashing down, but I do know whenever we look through history and we see these patterns, it doesn’t end well. So make sure you’re prepared. We recently went over how in the article, “How to Prepare for the Great Reset.”

What’s Coming Next?

So why do I bring all this up? Why do I continue to focus on these economic issues? Because this is directly relevant to bible prophecy. As we mentioned in this article back in August, “How the Current Global Financial Crisis Leads to Biblical Tyranny in 10 Steps,” this is going to lead to the greatest financial calamity in the history of the world. It will be just as severe as the Great Depression.

This involves more than just a stock market crash or a commercial real estate crash or a residential real estate crash, all of which are happening or are on their way to happening. It also involves a currency crisis. And it involves a sovereign debt crisis as countries – entire nations – collapse under the weight of the debt they've piled up. And this will lead to a deflationary spiral worse than the Great Depression.

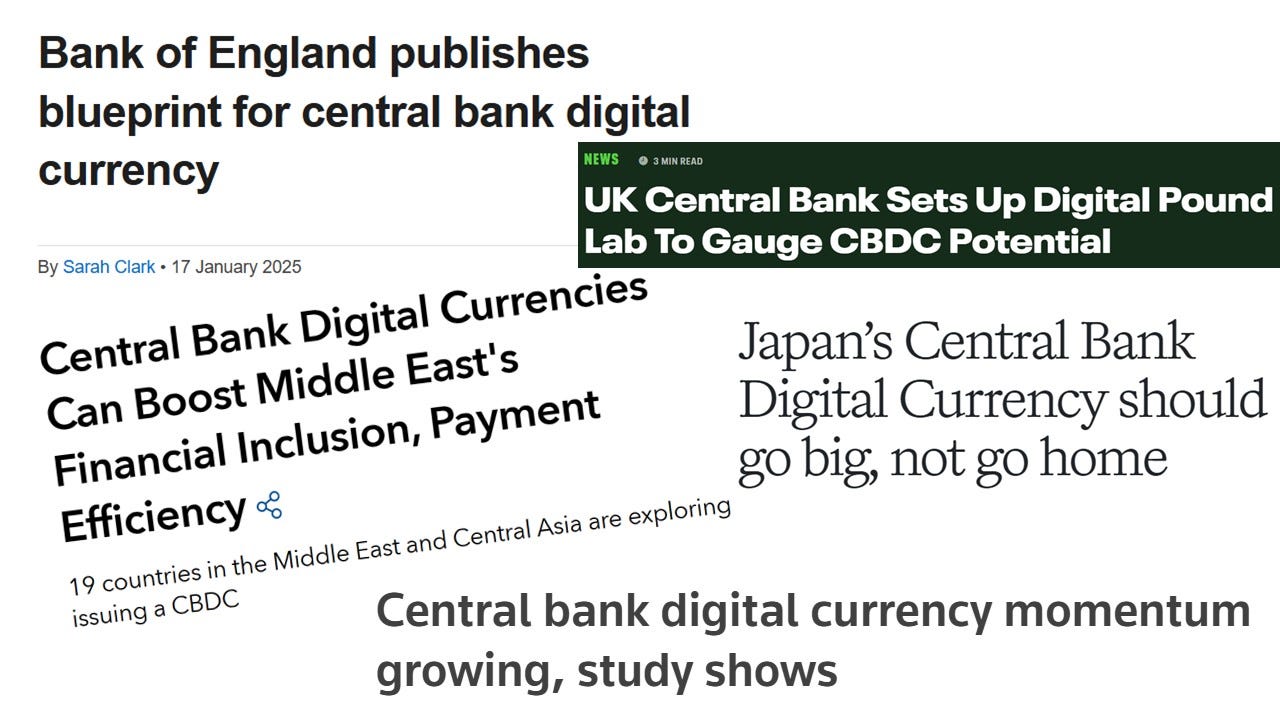

Eventually, it will result in a bank holiday, and the rollout of a new system that includes central bank digital currency (CBDC), tokenized assets, and digital IDs. They've already told us this is what they want to do. They've been telling us for years.

Here’s a website where they track the roll-out status of CBDC all over the world.

Why are they doing this? Because they know we're at the end of the current system. They know it will collapse in the near future, and they need to replace it with a new system that entrenches the power of those who are in power now. And this is the system they've decided on - CBDCs, tokenized assets, and digital IDs.

Why does that matter? Because those three technologies, when implemented, are indistinguishable from the mark of the beast in terms of function and capability. They aren't the mark of the beast themselves. But they create a system where the government will have insight into every financial transaction. And not just insight and surveillance of those transactions, but the ability to control those financial transactions – the ability to cut them off, redirect them, and/or place limits on them. Such a system gives the government complete and utter control over every aspect of human life.

How will they get people to accept such a system? First, they need a crisis. The greatest financial and economic crisis in human history is exactly what they need. When people are desperate, when they can't afford food, when they can't afford rent, when they can't make the mortgage payment, when the entire economy collapses and the world seems to be coming to an end – that’s when they’ll have public support to roll it out.

They’ll claim, “Here’s the solution. This will restore your fortunes!”

Just enter the new system, and they’ll restore the funds in your bank account, the funds in your retirement account, and they’ll have the regulatory authority to make sure nothing like this ever happens again. The downside?

Only this – you'll have to give up your privacy and enter a new system with control over every aspect of your life. They won't sell it as that. But people will buy it. This system is coming. The Bible foretold it almost 2,000 years ago in the Book of Revelation:

"He required everyone - small and great, rich and poor, free and slave - to be given a mark on the right hand or on the forehead. And no one could buy or sell anything without that mark, which was either the name of the beast or the number representing his name." Revelation 13:16-17 (NLT)

Here, we read about the mark of the beast system, and what it’s able to do. What it does is indistinguishable from what this new system will be able to do.

We are seeing the infrastructure constructed here in our day and time right before our eyes. And Jesus said:

"So when all these things begin to happen, stand and look up, for your salvation is near!" Luke 21:28 (NLT)

Jesus is coming back. That's where your hope should be.

If you liked reading this, please click the ❤️ button on this post so more people can discover it on Substack 🙏 or share it with your loved ones and spread the Good News that Jesus is coming!

Wow you can’t make this up ,

Dogecoin & Fartcoin 😂😂😂

Thanks again Britt. It's coming.

God bless & Maranatha!!! 🐑 ✝️ 🇮🇱