The world is now facing the worst economic environment since the Great Depression, and before the dust settles, the world will also witness the greatest financial crisis in human history.

A debt-based monetary system (such as the one the world runs on today) is much like a Ponzi scheme. It requires ever increasing amounts of debt to avoid implosion - just as a Ponzi scheme implodes once it runs out of new investor cash.

In a system such as ours, once debt reaches its pinnacle, the system starts to collapse. This is because bankruptcies and defaults result in a shrinking currency supply, and that shrinking currency supply makes it more difficult for other borrowers to meet their debt obligations. This, in turn, leads to more defaults/bankruptcies and further shrinking of the currency supply. This vicious cycle continues until it reaches a free market equilibrium, and then growth can begin anew.

This process is known as a deflationary spiral.

The Great Depression was a deflationary spiral spurred on by massive central bank credit creation, and we’ve seen many of the same policy mistakes that led to the Great Depression repeated our day and time – most notably, massive central bank credit creation in the aftermath of both the Great Financial Crisis and the COVID pandemic.

Now, the consequences of those poor policy decisions threaten to plunge the world into a new economic depression.

Below are five signs we’re already in a global depression, and one set to get much worse before it gets better:

1) A Global Trade War

Following the Trump administration’s tariff announcements on April 2nd, the world is now engaged in a trade war in addition the deflationary problems it’s already dealing with.

As reported by CNN:

“President Donald Trump on Wednesday unveiled expansive new tariffs in a major escalation of his trade war, referring to the historic move as a “declaration of economic independence.”

Using national emergency powers, Trump announced 10% tariffs on all imports into the United States, and even higher tariffs on goods from about 60 countries or trading blocs that have a high trade deficit with the US. That includes China and the European Union, which will be levied new duties of 34% and 20%, respectively.”

In response, China’s Finance Ministry said it will impose a 34% tariff on all goods imported from the U.S. starting on April 10. Meanwhile, Reuters reports the European Commission offered a "zero-for-zero" tariff deal to avert a trade war with United States as EU ministers agreed to prioritize negotiations, while striking back with 25% tariffs on some U.S. imports.

This is eerily similar to the passage of the Smoot-Hawley Tariff Act in 1930, which sparked a global trade war and exacerbated the global depression already underway. We're seeing signs of similar damage taking place as a result of today's tariffs.

Here are some examples of the global impact:

As reported by NBC:

"Jaguar Land Rover will pause shipments of its Britain-made cars to the United States for a month, it said on Saturday, as it considers how to mitigate the cost of President Donald Trump’s 25% tariff."

As reported by CNBC:

"Stellantis is pausing production at two assembly plants in Canada and Mexico as the company attempts to navigate President Donald Trump’s new round of 25% automotive tariffs, the company confirmed Thursday."

In addition to the tariffs themselves, one of the biggest problems businesses now face is uncertainty itself. Regardless of whether the trade war now underway results in higher or lower tariffs, businesses face increased uncertainty when it comes to planning and making decisions on future capital expenditures. This uncertainty is illustrated in the chart below:

And many of these companies make up an outsized portion of the average person’s retirement accounts.

In my January 21st article, "This is the Biggest Speculative Bubble Since 1929… It Will End in Similar Fashion," I pointed out Apple comprised 7.41% of the S&P 500 index – a larger percentage than any other company. It also sported a price-to-sales ratio of 9.65 and a price-to-earnings ratio of 39.8 – both of which are extreme overvaluations for a mature company such as Apple.

Now, tariffs threaten to totally upend Apple's profitability. As ZeroHedge reports in "'This Could Blow Up Apple' iPhone Maker Plummets; Most Impacted By Tariffs Among Mag7s":

“Apple shares are plunging almost 10% in premarket trading, as the iPhone maker is viewed as especially exposed to the Trump administration’s tariff announcements.

As Bloomberg economists write in an overnight report (available to pro subs), ‘the US reciprocal 34% tariff on China and other nations where Apple has manufacturing will likely amplify operating-margin deterioration, given we don’t expect the company to hike prices to offset the effects.’ They add that revenue growth ‘could remain under pressure if Apple does raise product prices, in addition to uneasy consumer sentiment, which might delay upgrades.’”

But tariffs are just the tip of the iceberg, we also face this…

2) A Broken U.S. Economy

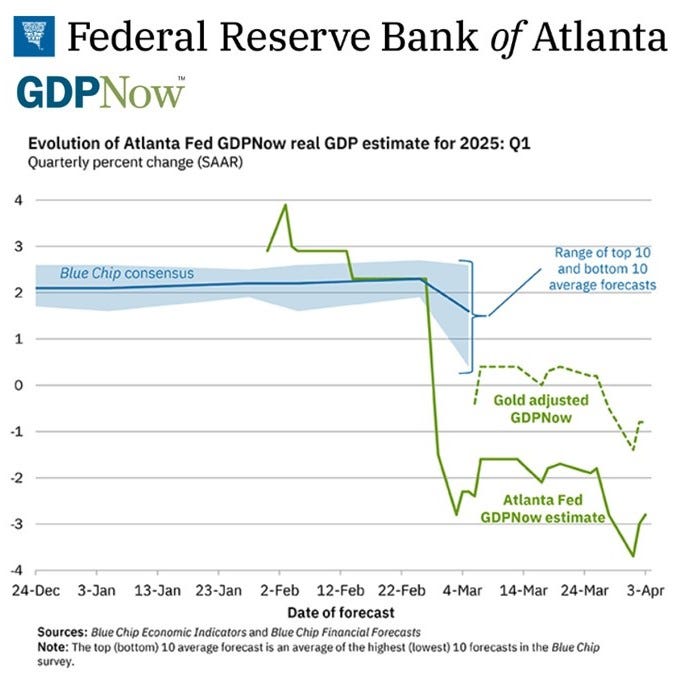

The Federal Reserve Bank of Atlanta now expects first quarter GDP to be -2.8%:

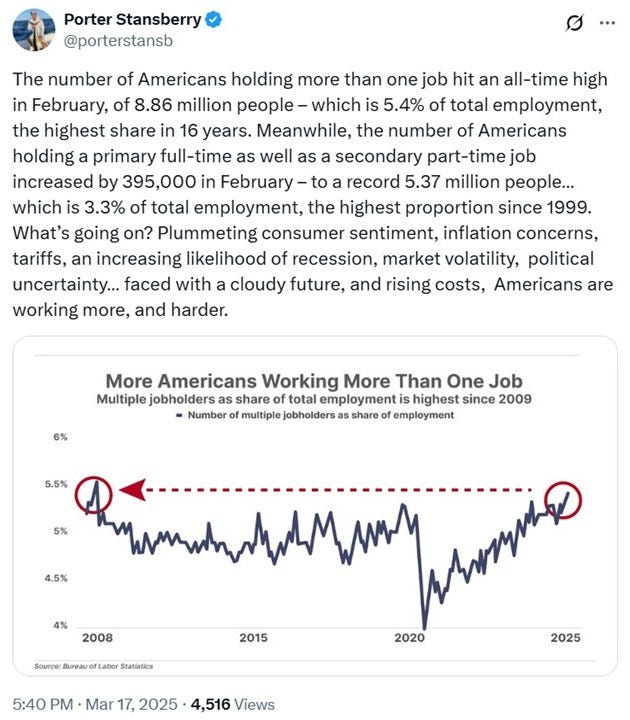

This is despite Americans working more than ever:

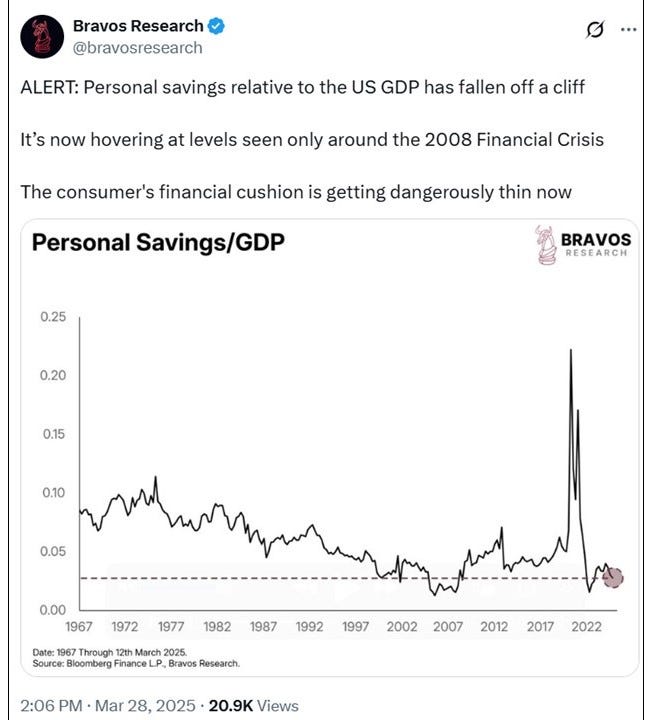

And despite working more than ever, personal savings are plummeting for most Americans:

The American consumer is simply crushed under the weight of heightened inflation, mountainous debt, and poor choices. Nothing better illustrates this situation than the recent announcement of a partnership between DoorDash and Klarna:

The partnership gives consumers "more freedom to choose how they want to pay." So the next time you order food marked up with an expensive delivery charge, you can pay in "four equal interest-free installments" or "defer payments to a more convenient time." For example, you can pay for your Chick-Fil-A chicken sandwich over a period of 36 months. Sounds like a great idea, right?

It's really no different than charging all your food to a credit card and paying two to three times as much for the food over time as you carry a balance. And as Debt.com’s most recent survey shows. Most Americans are struggling under the weight of massive credit card debt.

As reported in "Debt.com’s 2025 Survey Exposes Disturbing Trends in Credit Card Debt as Inflation Continues to Pressure Americans’ Finances":

As policymakers push forward with efforts to cap steep credit card interest rates, the latest Credit Card Survey from Debt.com sheds light on how inflation has significantly impacted the financial stability of Americans—and how many are still struggling to dig their way out of debt.

For the second year in a row, one in three Americans say they rely on credit cards to make ends meet, with a growing number already maxed out. The national poll of 1,000 adults illustrates how rising costs have shifted credit cards from being a tool of convenience to a lifeline for survival.

Key Findings from Debt.com’s 2025 Credit Card Survey:

32% of Americans have maxed out their credit cards

37% use credit cards regularly just to make ends meet

44% say inflation has caused them to carry a larger monthly balance

Of those maxed out, 80% would rely on credit cards during a financial emergency, and 23% owe more than $20,000 in credit card debt

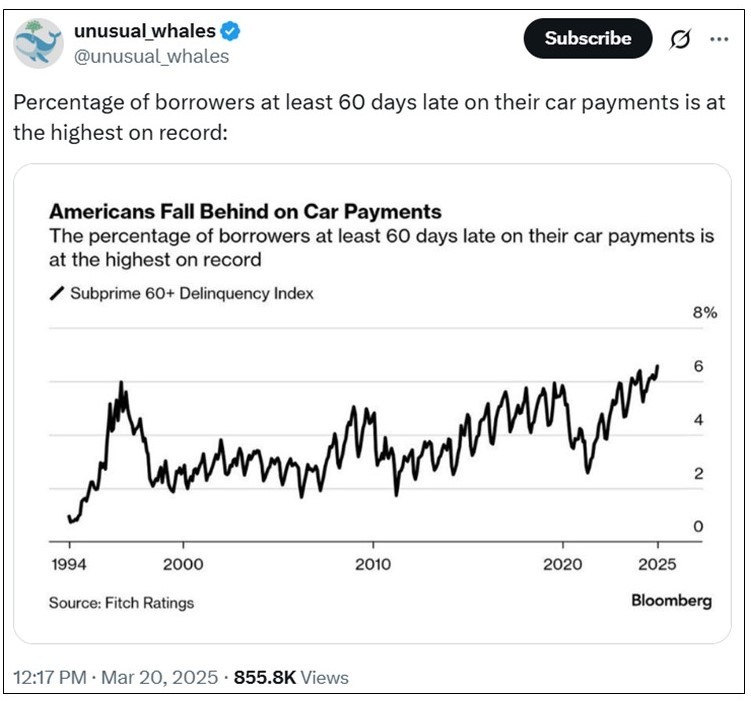

Americans are also struggling to pay off their auto loans. Many are falling behind:

The Federal Reserve Bank of New York reports, “High auto loan delinquency rates are broad-based across credit scores and income levels.”

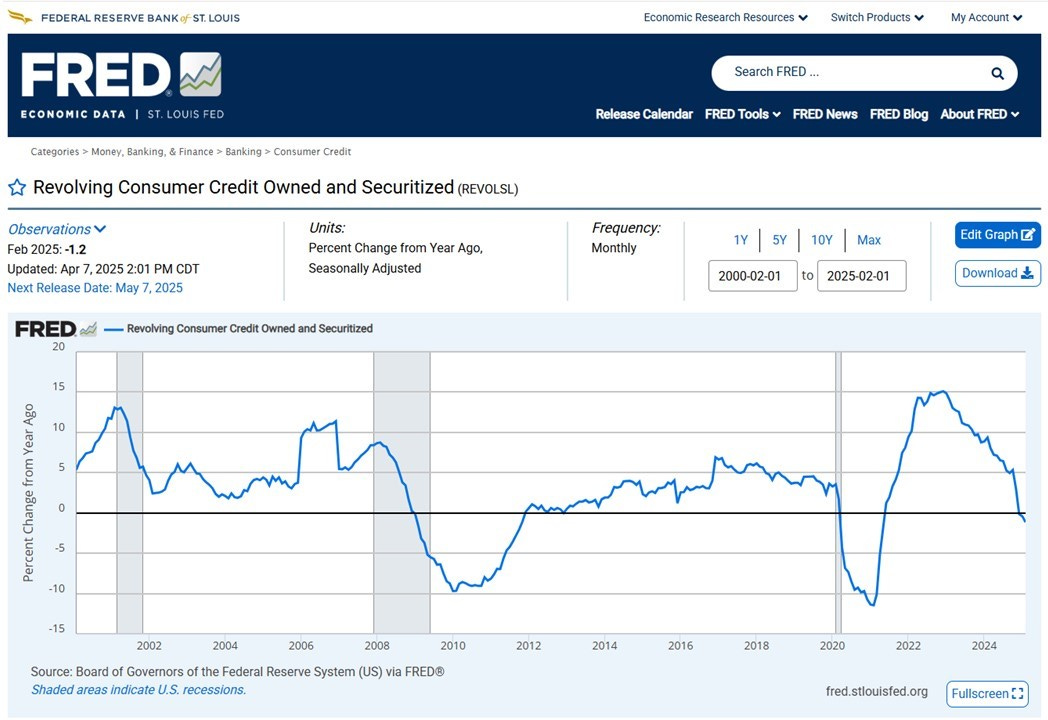

The burden of debt is so crushing for the average American, revolving consumer credit is in contraction for only the third time in recent memory. The other two times? The period of the Great Financial Crisis (2009-2011) and pandemic lockdowns (2020):

This is a big problem for the largest economy in the world. As previously mentioned, our monetary system is a debt-based monetary system. In order to function properly, it requires ever greater amounts of debt to be issued. Once the debt stops growing, we enter a deflationary spiral and everything breaks.

And that’s a big problem, because the second largest economy in the world (China) is already trapped in a deflationary spiral…

This work is a full-time endeavor for our family. Without the support of readers, viewers, and listeners like you, the work we do here would not be possible. If you like what you see, please consider becoming a paid subscriber.

As a paid subscriber, you’ll get weekly paid-subscriber videos and/or articles, a monthly live Q&A via Zoom, commenting privileges on every post, access to the complete archives, and more. Most of all, you get to support this work which spreads the Good News of Jesus Christ to tens of thousands of people in over 100 countries.

3) The Second Largest Economy Trapped in Deflation

As the world’s #2 economy, China is already trapped in a deflationary spiral, having lost over $18 trillion in its property sector alone since 2021 according to Barclays. And as of yet, we see no indications the situation will change any time soon.

As reported on GISReportsOnline:

“When Xi Jinping became president in March 2013, there was widespread optimism across China. At that time, many Chinese economists held a linear viewpoint, believing that the country’s development would progress continuously. However, today, China finds itself trapped in a deflationary cycle.

Deflation occurs when weak demand leads to falling prices for goods and services, especially industrial products. Food staples are typically less affected. This price decline results in consumers and businesses refraining from purchases as they expect even lower prices in the future, which can trigger drops in wages and set the stage for a recession. China has been experiencing continuous deflation, with prices falling for six consecutive quarters. Traditionally, Beijing has responded to deflation with aggressive monetary easing and fiscal stimulus. However, since the Covid-19 pandemic, the government has taken a more cautious approach to prevent a rise in debt.”

And as AP News reports:

"When he bought an apartment near a good high school in northeast Beijing in 2020, Zhou Fujin expected that renting it out would cover most of his mortgage. But the apartment’s value and the rent he is getting have plummeted in the past couple years, straining his family’s finances.

China is experiencing a spell of deflation, or falling prices, that contrasts with inflationary pressures prevailing elsewhere in the world. Cheaper prices can be a blessing for some, but deflation is a symptom of relatively weak demand and stalling economic growth."

As reported in the South China Morning Post:

“China must unleash a “more significant” monetary stimulus beyond its recently released growth plans to dispel market fears of deflation and boost domestic demand amid an intensifying trade war with the United States, a senior economist has warned.”

Reuters reports a record three million Chinese restaurants closed their doors in 2024 as restaurants engage in price wars to win over reluctant diners.

Meanwhile, Nike warned of plunging sales, citing a number of factors including China. Sales for their most recent quarter "were down 9%, driven by weakness in China" with sales falling "17% in the key region to $1.73 billion."

Right now, China is ground zero for the global deflationary spiral poised to ravage the entire global economy. But other nations aren’t far behind…

4) German Deindustrialization

As the world’s third largest economy, Germany is undergoing a period of deindustrialization. Following the launch of the Russia-Ukraine war, German simply hasn’t had the access to cheap, reliable energy it had before the war broke out. Combined with a series of green policy initiatives that have shut down German coal and nuclear power plants, many German companies face the choice of bankruptcy or relocating their operations abroad.

In February 2025, industrial production declined 1.3% month-over-month and 4% year-over-year. Is it any wonder economists are slashing their growth forecasts?

As CNBC reports:

"The German government on Wednesday slashed its gross domestic product forecast to just 0.3% growth in 2025.

'The diagnosis is serious,' Robert Habeck, economy and climate minister, said during a press conference, according to a CNBC translation. He noted that, while there are some positive developments such as rising demand for credit, 'Germany is stuck in stagnation.'

The latest GDP estimate is sharply down from an October projection of 1.1% growth this year, but broadly in line with forecasts from other economic bodies. The International Monetary Fund earlier this month cut its outlook and now sees 0.3% growth for the German economy this year, while the federal Bundesbank in December said it was anticipating the GDP to increase by 0.2% over the period."

Notable long-time German industrial behemoths are shedding jobs and moving factories abroad:

And the trade war threatens to make things worse:

The slow and steady deindustrialization of Germany was best illustrated in late 2022, when four German companies – all more than 125 years old – were declared insolvent in a single day. And all these companies were in different industries. They included a construction company, a sweets manufacturer, a car component supplier, and a soap manufacturer.

In Germany, we’re witnessing an absolute dismantling of the world’s third largest economy. But unfortunately, the situation gets worse…

5) Japan Locked in a Currency Crisis

As bad as things are in the United States, China, and Germany, they're even worse in the world's fourth largest economy - Japan. In my May 2024 article, “6 Potential Triggers for the Next Global Financial Crisis,” I listed the second trigger as a Japanese currency crisis:

“Meanwhile, the world’s fourth largest economy is on the verge of a major currency crisis. The Japanese yen currently sits at its lowest level relative to the U.S. dollar since 1990. To prevent the situation from getting worse will likely require the Bank of Japan to raise interest rates or the U.S. Federal Reserve to lower interest rates. Given the recent persistence of inflation, it’s unlikely we’ll see the U.S. lower rates in the short-term (absent a major financial crisis). This means the Bank of Japan may be forced to raise rates and take other measures to defend its currency.

But this will cause a number of problems. First, the Japanese economy is in recession. Raising rates will only make the problem worse. Second, Japanese government debt stands at over 260% of GDP. Believe it or not, that’s twice as bad as the United States. Raising rates means more interest on the national debt, potentially sparking a debt spiral that could destroy the country. Furthermore, if the Bank of Japan starts hiking rates, this could cause a reversal of the yen carry trade (succinctly explained here), which could quickly lead to a disorderly unraveling of financial positions all over the world. Along the way, we could see margin calls and exploding derivatives positions that crash global financial markets.”

And as mentioned in my August 2024 article, "How the Current Global Financial Crisis Leads to Biblical Tyranny (in 10 Steps)," that means Japan is trapped:

“The Bank of Japan can choose one of two roads:

1) Raise Interest Rates and Destroy the Domestic Economy

Raising rates will strengthen the yen. But as we saw last week, it will also lead to a reversal of the yen carry trade with enormous implications for global financial markets. It will also weaken the Japanese economy, and increase the interest paid on a Japanese government debt load too onerous to ever be paid back. In addition, it puts further strain on the Japanese banking system by increasing the amount of unrealized losses on bank balance sheets – likely resulting in bank runs. Ultimately, raising interest rates will destroy the Japanese economy.

or

2) Lower Interest Rates and Destroy the Domestic Economy

Likewise, lowering rates will cause the yen to depreciate relative to other currencies (in particular, the dollar). While it will decrease the stress on Japanese bank balance sheets and the amount of interest paid on the Japanese government debt, it will unleash domestic inflation sure to ravage the finances of the average Japanese citizen. More and more of the average household budget will be earmarked for essentials, and discretionary consumer spending will contract. Worst of all, increased fossil fuel prices will weigh down every aspect of the economy, as Japan remains heavily reliant on imported oil. And that oil needs to be purchased in dollars using an ever increasing number of yen. Ultimately, lowering interest rates will destroy the Japanese economy.

In case you missed it, the big takeaway is this – no matter what the Bank of Japan does, the result will be the same. And, as the fourth largest economy in the world, the destruction of the Japanese economy (whether through a deflationary spiral or hyperinflationary collapse) will severely weaken the entire global economy. Moreover, this is happening while almost every other industrialized nation in the world is on the brink of economic calamity due their own problems with over-indebtedness.

That’s why this crisis is far from over. In fact, just ahead of us is the greatest economic and financial crisis in history.”

And now tariffs are making the situation worse:

"Investors also now have their eyes set on the USD/JPY currency pair as the US has placed a 25% tariff on cars and 24% on other goods coming from Japan. So far, Japan has responded calmly and says it is willing to talk.

There is no doubt that US tariffs, especially those targeting Japan’s key industry—automobiles—are a serious problem for the government in Tokyo. If talks fail, Japan’s economy could slow down even more in the coming months. Growth is already weak, with quarterly figures staying below 1%."

In light of the problems the Bank of Japan faces, is it any surprise Treasury Secretary Scott Bessent has been put directly in charge of trade negotiations with Japan - "with tariffs and currency rates expected to be on the agenda"?

The Trump administration is trying to thread the needle with its tariff policies. The odds they’ll succeed are extremely low. The April 2nd tariff announcements were nothing less than a global economic earthquake, and it’s highly likely that earthquake triggered a major tsunami that will soon hit shore.

Prepare for the Fallout

Given the state of the global economy – with the first, second, and third largest economies in the world all in outright contraction – is this the best time for a trade war? No. The uncertainty of the trade war alone, aside from the risk of retaliatory tariffs, is already halting economic activity.

The global economy is broken, and the risk of something big breaking within the depths of the global financial system increases with each passing day. Last week, The Daily Mail reported, "Hedge funds are facing Lehman-style margin calls as a market crash triggered by President Donald Trump's tariffs raises fears of a looming 'Black Monday.'"

What happens when the market realizes the Bank of Japan has reached the end of the road? What happens when the world wakes up to the realization the world’s fourth largest economy has either defaulted on its government obligations and/or decided to hyperinflate its currency? The margin calls will exceed anything the world has ever witnessed.

As overleveraged hedge funds, family offices, and banks implode, prepare to see mass panic in financial markets as a derivatives complex valued in the quadrillions of dollars collapses.

As credit markets freeze due to counterparty risk, prepare for a bank holiday and a complete shutdown of the entire global economy – one far worse than the pandemic shutdown.

Prepare for the greatest financial crisis the world has ever seen.

And remember this – “the solution” is conveniently waiting in the wings.

If you liked reading this, please click the ❤️ button on this post so more people can discover it on Substack 🙏 or share it with your loved ones and spread the Good News that Jesus is coming!

Hi Britt and Jenny and family, God's blessings for you today and every day.

We have been talking about this for a while now, and I know it's coming. It's hard for people without much money to survive this great depression, I know Our Lord Jesus Christ will supply all our needs as we put our trust in Him.

Do you think when this happens, it will lead to lawlessness and widespread panic in the people who do not know Jesus Christ as their Savior? We already know it will. I'm praying with my whole heart for the Lord Jesus Christ to guide us through. I pray the Rapture happens 🙏..but only God knows.

God bless you and your family, and all my brothers and sisters in Christ Jesus our Lord.

When all said and done -Jesus is our banker-we all need to make sure each of us and others make a deposit with our soul into HIS safety box to be sure we are withdrawn from this unsettled world of commerce and from the chaos formed from the prince of this world…..